PowerClerk Support Center

- Project Pages

- Program Design Menu

-

- Automations

- Channels

- Communications

- Connections

- Content Library

- Custom API IDs

- Data Fields

- Deadlines

-

- Questions to ask yourself

- Locating the Deadlines feature

- What are Deadlines

- How to Create a Deadline

- Deadline Automation Action Rules

- Utilizing Project Admin Page for Deadlines

- Communication Templates for Deadlines

- Deadline Set/Satisfy Options

- Program-Wide Deadline Actions

- Reporting on Deadlines

- Deadlines in Project List Columns

- FAQs

- Document Templates

- eSignature Envelopes

-

- Questions to Ask

- Locating the eSignature Feature

- What are eSignature Envelopes?

- eSignature Checklist: The Prerequisites to create a new Envelope

- How to set up Advanced eSignature Envelopes Step-by-Step

- How to add an eSignature Envelope to a form

- eSignature Automation Trigger

- Viewing Completed eSignature Envelopes

- Resending eSignature Notifications

- Canceling eSignatures

- FAQs

- Forms

-

- Questions to ask yourself

- Locating the Forms feature

- How to create and edit Forms

- Adding data fields

- Form Versions and Draft Forms

- Configuring Forms

- Form Field Elements

- Field Properties

- Conditional Visibility

- Sensitive Data Fields

- Location Form Element

- Address Autocomplete

- Exporting a Form to Excel

- VersaForms

- FAQs

- Formulas and Calculated Fields

- Front Page

- Incentive Design

- Milestones

- Project List Columns

- Project Summary

- Project Views

- Roles

- Themes

- Workflow

- Admin Menu

- Tools Menu

-

- My Account

-

- Questions to Ask

- Locating the My Account feature

- How to use the My Account feature

- Lockouts and Password Resets

- Setting up Multi-Factor Authentication

- Missing, lost, or stolen mobile devices: resetting Multi-Factor Authentication

- Disabling Multi-Factor Authentication

- Recovery Guidelines for MFA Administrators

- FAQs

- FormSense

- Grant Access

- Integration Guides & API

- PowerClerk Video Guides

-

- Setting up Roll-up Reports

- New User Video Guide

- Configuring Forms

- Roles and User Administration

- Setting up Business Days

- Formulas and Advanced Visibility Rules

- Visualize Workflows

- Dashboards

- FormSense

- Milestones

- ArcGIS

- Project Summary

- Automation with Formulas in Action Rules

- API

- Edit Forms - Tutorial #1

- SFTP Automatic Data Import

- Calculated Fields

- Web Connector Setup

- Edit Forms - Tutorial #2

- Build A Formula

- Help Articles

- PowerClerk Program Launch

- PowerClerk User Group Sessions (UGS)

- Learning Management System (LMS)

- Join us for Reflow!

- NEW: PowerClerk Certifications

ePayments

Streamline credit card payments for application fees with secure payment processing.

Questions to ask yourself about ePayments:

What payment provider can I use in PowerClerk?

How do I calculate my fees with Formulas?

Where do I see a report of my ePayments?

How do I set up my Stripe account?

How can I tell if my customer made their payment?

ePayment Integrations

ePayments

PowerClerk supports electronic payments (ePayments) with various payment providers. Stripe (www.stripe.com) is the recommended payment provider for PowerClerk, as it offers enhanced features that are built into the PowerClerk. PowerClerk also has integrations available for Paymentus and KUBRA EZ-PAY.

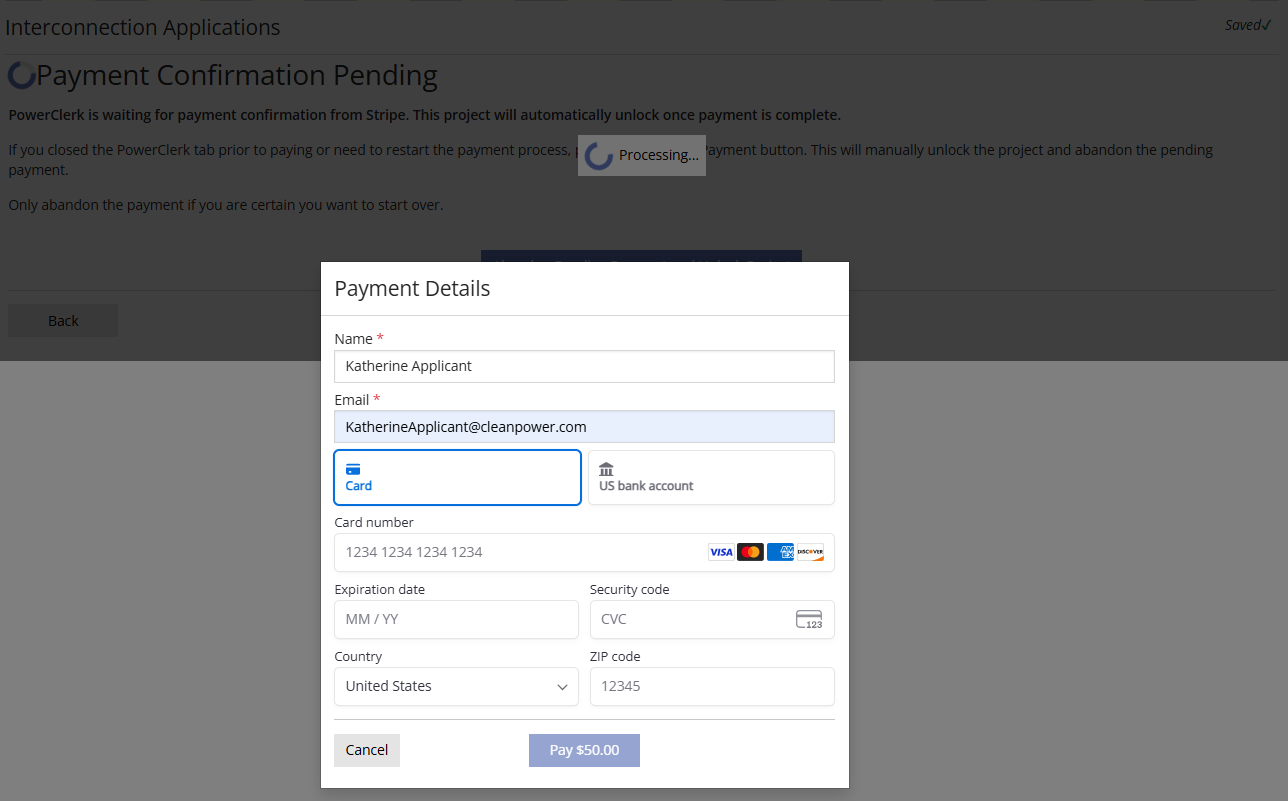

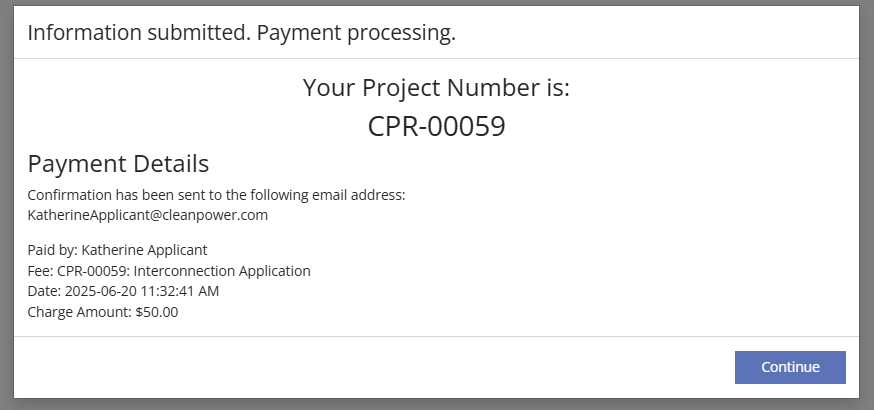

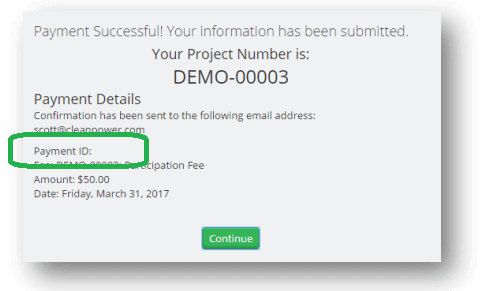

The ePayments feature is integrated into PowerClerk’s Forms, allowing Program Designers to specify which form(s) require payment and whether payment is mandatory for submission. Transactions are processed within seconds via a popup dialog hosted by the payment provider (see Figure below), so users can seamlessly complete payments within the PowerClerk form submission process. Payment confirmations are displayed to the payer once payment has been successfully submitted and will be immediately visible on the Admin Project page for the project. Additionally, an email confirmation is automatically sent to the payer. Payment status reports are available through the payment provider.

Integrating ePayments into PowerClerk typically involves the following steps:

- Establish a Merchant Account – The utility or agency sets up a merchant account directly with their chosen payment provider.

- Integrate with PowerClerk – The utility or agency works to integrate the selected payment provider with PowerClerk. Please note, for guidance and additional information on adding ePayments to your PowerClerk program, please contact your account executive.

- Configure ePayments on Forms – Once the integration is complete, you can configure any Form within PowerClerk to include an ePayment option.

- Applicant Submission & Payment – Once ePayments are configured for a form, PowerClerk automatically adds an ePayment tab as the final step of the submission process. On this tab, applicants can view payment details and complete their payment through the integrated provider. If the payment is marked as required, the form cannot be submitted until the payment has been successfully completed.

- Payment Complete Receipt – After a payment is submitted, PowerClerk records the payment status and displays a confirmation message to the applicant. The integrated payment provider notifies PowerClerk once the payment is successfully processed, and a receipt record is saved within the system for tracking and reference.

Note: Payment information—such as credit card numbers—is not visible to Clean Power Research and is never stored in PowerClerk.

How to Integrate with ePayment Providers

The setup process will vary depending on the selected payment provider. For Stripe, Paymentus and KUBRA EZ-PAY, integration and configuration must be completed in conjunction with a CPR Admin using payment credentials provided by the utility. For more information or assistance with integrating these payment providers, please contact your Account Executive.

If you’re using Stripe, once the initial integration setup has been completed in coordination with a CPR Admin, you can connect your Stripe account directly to your PowerClerk program. To do this, ensure your user role includes the “ePayment Management” permission, which grants access to the ePayment Management menu item. From there, you can select the Connect with Stripe tab to sync your Stripe account with PowerClerk. For detailed setup instructions, please refer to the ePayment Management article.

Note: The ePayment Management page is a Stripe-specific enhancement and is not available for other ePayment providers.

How to Set up ePayments on a Form

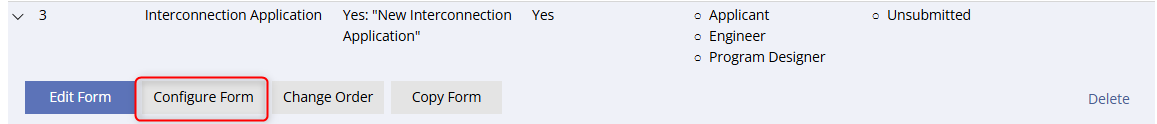

Once the PowerClerk program has been integrated with an ePayment provider, go to Forms (Program Design >> Forms).

Then complete the following ePayment configurations:

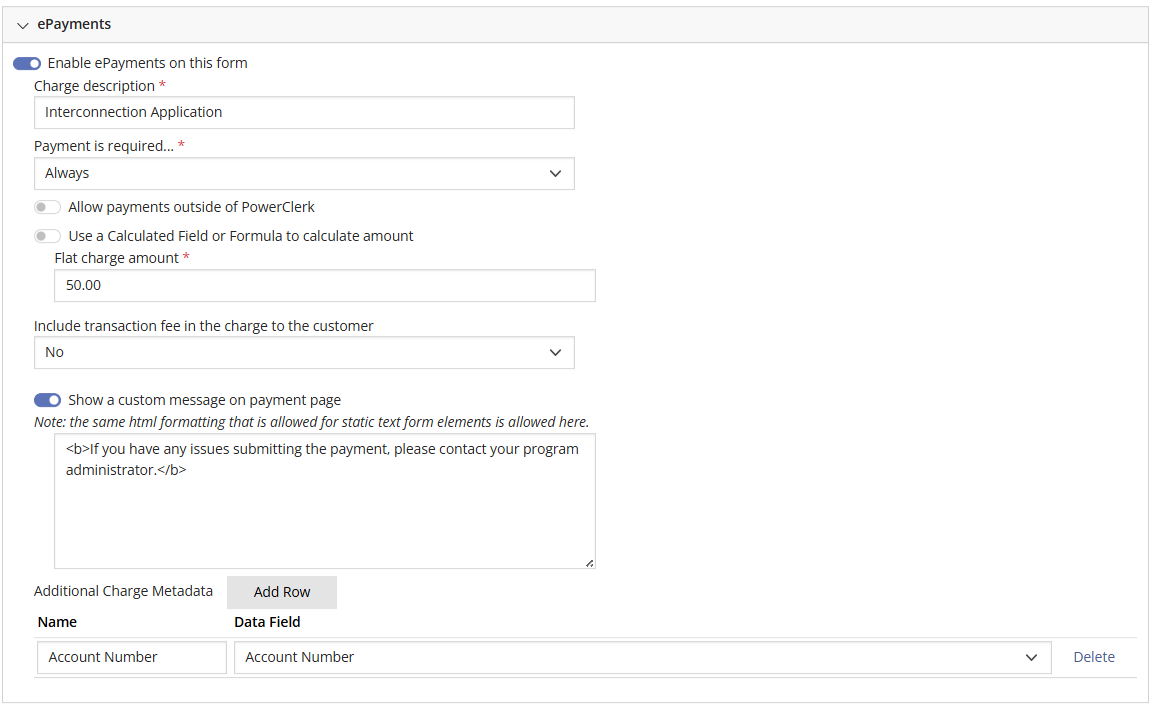

- Enable ePayments on this form – Turn this setting on to enable ePayments on the form, and to display configuration options. When ePayments are active, a Proceed to Payment button will appear on the final tab of the form. Clicking this button will take the user to an additional ePayment tab, where they can confirm their intent to pay and initiate the transition with the payment provider.

- Charge description – Specify the name of the payment. This will be displayed as the payment label to the user.

- Payment is required – Determine when payment is required by selecting one of the following options: Only the first time the form is submitted, Always, or If calculated field or Formula is true.

- Allow payments outside of PowerClerk – Enable this option to accept payments made externally from PowerClerk. Please note: The payment status will not be reflected in PowerClerk until the associated project is opened on the Admin Project Page.

- Use a Calculated Field or Formula to calculate the amount – Specify a formula or calculated field to dynamically determine the payment amount. If no formula is provided, a flat-rate amount can be entered instead.

- Include transaction fee in the charge to the customer – Enable this setting to pass the transaction fee on to the applicant. If enabled, users will be notified of the surcharge before completing their payment. Please Note: By enabling this option, you acknowledge and accept responsibility for complying with all applicable laws and regulations.

- Show a custom message on payment page – Add a custom message to be displayed on the payment page. HTML formatting supported in Static Text Form Elements can also be used here.

- Additional Charge Metadata – Configure each submission to include additional metadata, such as selected PowerClerk data fields, alongside the PowerClerk Project Number. Please Note: If you’re not using Stripe as your payment provider, developer support may be required to configure these data fields. For additional information, please contact your account executive.

Managing ePayments

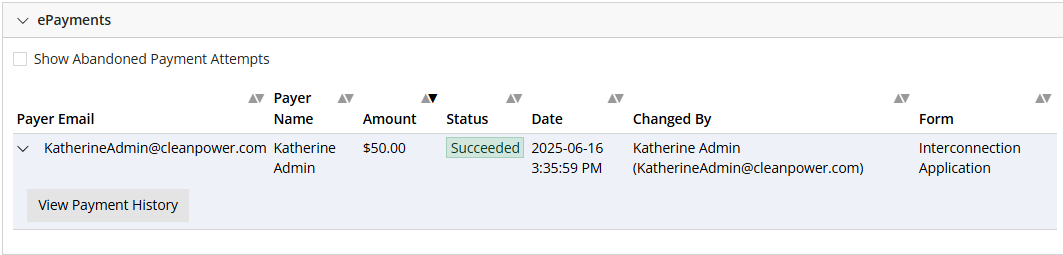

Once an ePayment has been processed, there are two ways to view and manage it: through the Admin Project Page or the ePayment History Page. The ePayment History Page provides a comprehensive overview of all processed payments along with their current status.

To learn more about the ePayment History Page, please click here.

Reporting on ePayments

Currently PowerClerk Reports do not support reporting on ePayments. The ePayments History (Admin >> ePayment History) allows you to export the history view into a CSV. This CSV contains the: Project Number, Payer Email, Payer Name, Amount, Status, Date, Changed by, Form and Receipt Number.

ePayments in Test Environments

Test credentials for ePayments can be configured by a CPR Admin. If you would like to set up test credentials for your program, please contact the Support team by submitting a request through the Ticket System. Be sure to include the program name and the specific test credentials you wish to apply.

Test environments will automatically use the corresponding test credentials. If test credentials have not been configured, ePayments will not function in the test environment.

FAQs

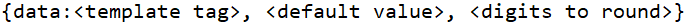

For example you can round a decimal value of 100.12345678999 to 3 digits after the decimal sign by using {data: datafield,,3} which will then display in your Document Template as "100.123". This won't effect the data fields actual value stored within the database, where you will retain the full standard precision of 10 digits after the decimal sign.

- Create Account: Register at Stripe (Link: https://dashboard.stripe.com/register).

- Email Verification: Once registered, verify your email address by clicking the email verification link sent to the email used to sign up for the account.

- Activate Account: Activate your account by using the "Activate Account" option in the left-hand sidebar.

- Business Details: Enter jurisdiction name and Tax ID (TIN).

- Industry: Select "Government Services" under "Professional Services." Please ensure to set up your account as “Non-Profit”. When asked for your Social Security Number (SSN) for set up, please let Stripe Support know that you need to escalate your account set up to another department within Stripe that handles government identification and verification. Access the "Stripe Support" tab in the top right corner of the website. Indicate that you are a government entity attempting to set up an account without a Social Security Number. The support team will request additional information to verify your authorization to establish the account. Be prepared to provide the supplemental details they may ask for:

- Stripe Support Link: Business types

- Stripe Support Link: Tax ID verification

- Stripe Support Link: Documents for business verification

- Stripe Support Link: Supporting documents

- Stripe Support Link: Acceptable verification documents

- Stripe Support Link: Using IRS documentation

- Business Owners: Choose option "Continue with no owners."

- Fulfillment: Indicate "No" for selling of physical goods and select option "Within one day" for service delivery time.

- Statement Descriptor: Enter jurisdiction name for credit card statements and ensure the name you chose is easily identifiable to avoid potential chargebacks.

- Bank Details: Input routing and account number.

- Two-Step Authentication: Set up SMS or app authentication.

- Final Submission: Review and submit your entered data on the Summary page to complete your Stripe account creation.

Have additional questions? Contact us to nominate your FAQ and help others find answers to your own questions concerning this feature.

Create A Support Ticket

Not finding your answer here? Submit a question to our support team at the PowerClerk Ticket System and leverage the PowerClerk team’s expertise.